The pandemic, in its prime, affected the US investment banking sector aggressively, while the industry still struggles to recover from the economic adversities led by the virus-spread. Financial services firms in the investment banking domain are fighting their hardest to regain the former profitability in the business and be included among the best stocks in the market.

As an initiative to revive themselves, investment banking firms in the US have decided to traverse from conventional underwriting work to other alternatives, such as acquisitions advisory, fundraising, and M&A.

Amendments in the Regulatory Guidelines by the US Federal Govt.

The said change in strategy has largely been powered by some regulatory guidelines issued by the federal government, that have resulted in making a few of the investment banking functions costlier.

Further, the soaring demand for innovative customer-facing portals, sophisticated in-house applications, and higher security and transparency, across the business infrastructure has put the firms in the investment banking industry under significant pressure.

What Does the Market Surveys Say About the State of US Investment Banking?

According to Dow Jones index, US investment banking sector has seen its worst 1st quarter in the history, amid the fears of coronavirus and rising oil prices, a record drop of 21% since the start of 2020. But despite the crumbling start of the year, most of the stock-investors have not tried to sell the stocks, in hope for the market to revive soon.

Source: Statista

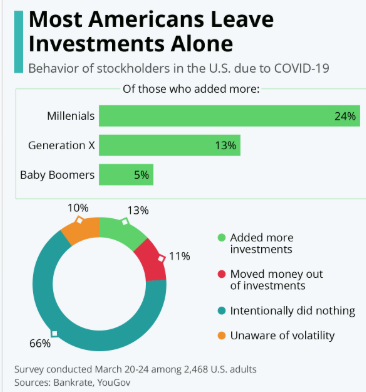

As per a joint survey conducted by YouGov and Bankrate at the start of April this year, 66% of the surveyees that have invested in the financial markets, said that they have purportedly left their stock-holdings untouched in the first quarter of the year. While 11% confirmed that they took out their investments from the financial markets. On the contrary, 13% bought more stocks in the first quarter of the year. 10% were not knowing that there has existed an economic volatility during the period.

Financial Advisors Want You Not to Pull Out Your Stock-Holdings

As seen in the stock market trends in the US, financial experts in the investment banking domain are glad about the fact that most of the investors have refrained from pulling out their stock-holdings. As per the trade experts, taking out your stock holdings en masse would have a fatal effect on the US economy. As per their sayings, the market has, historically, bounced back even harder, having tumbled like this.

Millennials Were the Profound Risk-Takers

To nobody’s surprise, millenials emerged as the biggest risk-takers when it comes to investment in the financial markets in the first quarter of 2020, when the pandemic was on its peak. As per Bankrate, 24% of the share of investors who purchased new stocks in the market, were millenials, in comparison to 13% of Generation X’ers & 10% from the generation of Baby Boomers.

Surprisingly, millenials also happen to be the ones that pulled out investments during the period in large numbers, i.e. 15%, in comparison to 12% & 8% from Generation X, and Baby Boomers, respectively.

Potential Challenges for the IB Industry Amid the Pandemic

Cost Reduction

Firms specific to investment banking domain in the financial markets, have been continuously chasing strategies that can bring about cost efficiency in their operations. But, the factors that have resisted them in doing so, comprises declining revenues, recent regulatory developments, and excessive costs.

Th strategy experts in the investment banking sector in the US, are directing IB firms to hit a balance between the optimization of the core banking functions, and making investments in completely new engagements.

Neutralizing Cyber-Attacks

Cyber-threats have been on a steep rise during the past decade, and wiith legacy technology existing, it has emerged as a big risk element. Investment banking firms are at a greater risk at the moment, than ever, of being attacked by the hackers, in the process of digital exchange of M&A confidential information.

Banks, in the recent past, have sought for protection from the law, but no concrete step has yet been taken by the federal government to safeguard them on the cybersecurity front. The onus to prevent unlawful data leaks and transfers, remains the responsibility of the IT teams of the IB firms.

Talent Retention & Acquisition

Banking professionals, these days, do not stay put in an investment banking firm for long, due to a lot of lucrative distractions, and opportunities before them. Despite the banks offering quick promotions, and impressive perks, young professionals are diverting to other promising industries such as technology, and start-ups.

Besides, the hectic lifestyle of a typical investment banker is not hidden from anyone. It involves odd, and long working hours, alongside frequent international travel for business purposes. Tight work deadlines has been a signature trend in the investment banking domain, since its inception.

Banks, seriously need to think on this front, which involves finding new ways to attract top talent, and making them stick to your firm for long.